As we move into September, the Calgary housing market is showing notable changes from the intense sellers' conditions experienced earlier this year. Recent trends indicate a shift toward a more balanced market, driven by easing sales and an increase in supply.

Key Highlights:

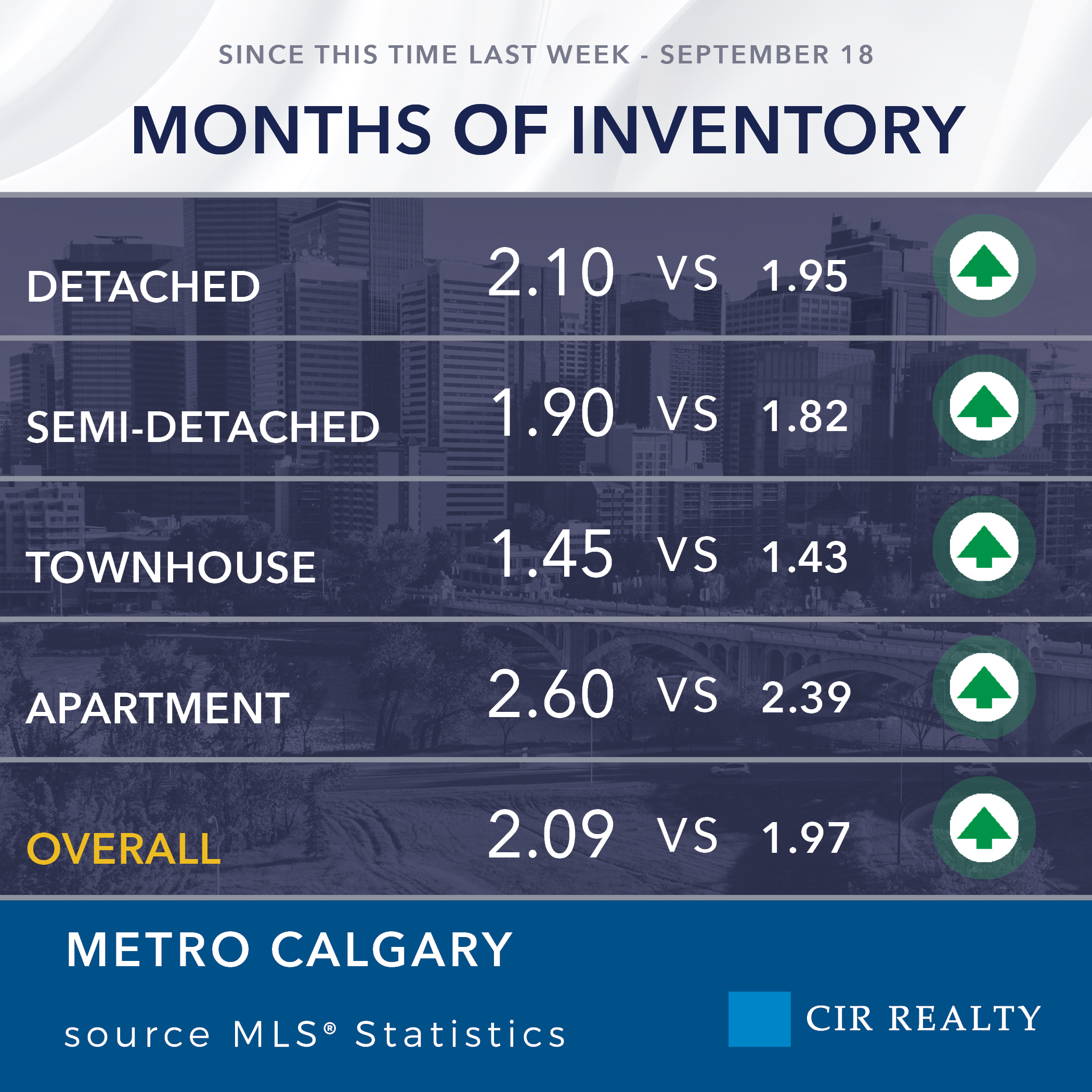

Increased Supply: In August, the months of supply surpassed two, a level we haven’t seen since late 2022. With inventory reaching 4,487 units, this marks a 37% increase from last August, although it still sits nearly 25% below long-term averages for this time of year.

Shifts in Sales Activity: August recorded 2,186 sales, down 20% from last year’s peak but still 17% higher than the long-term average for the month. Notably, the decline was most pronounced for homes priced under $600,000.

Price Growth Slowing: Following a period of strong growth, the pace of price increases is starting to slow. The unadjusted residential benchmark price in August stood at $601,800, which is 6% higher than last year, though it saw a slight dip compared to July. Year-to-date, the average benchmark price has risen by 9%.

Insights from CREB®

Ann-Marie Lurie, Chief Economist at CREB®, notes that the uptick in new home construction and new listings is contributing to a better-supplied market. However, she emphasizes that supply levels remain particularly low for more affordable properties, indicating that achieving a balanced market will take time.

What’s Next?

As we head into the fall, it will be interesting to see how these trends continue to evolve. While the market is gradually stabilizing, prospective buyers should remain aware of ongoing supply challenges in the lower price segments.

Stay tuned for more updates as we navigate the changing landscape of Calgary’s housing market!

-Edit-3.png)